td ameritrade tax withholding

Click Tax Tools lower left of your screen. Is the executing broker in the.

The kiddie tax is the tax liability on a childs unearned income or investment income.

. If youre looking for past years tax brackets check out the tables below. And TD Ameritrade Clearing Inc. Select the TD Ameritrade account thats right for you.

Holder in the US 2 in the. Learn more about New Horizon Financial. Federal income or withholding tax unless 1 such income is effectively connected with a trade or business conducted by such Non-US.

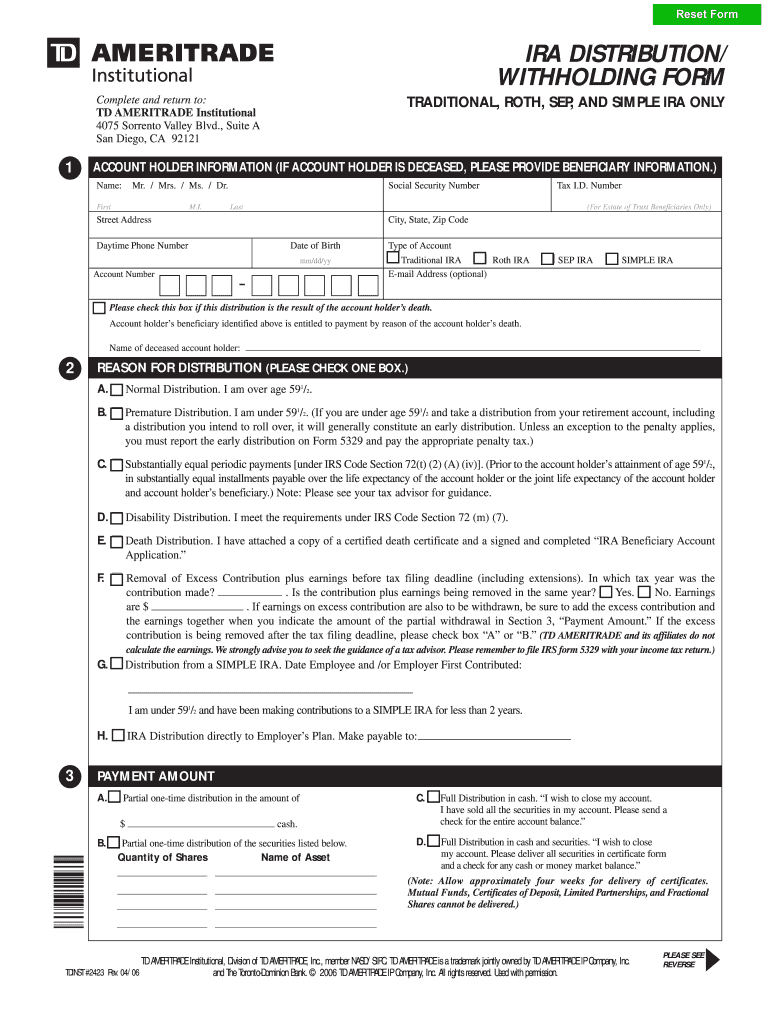

If your return isnt open youll need to sign in and click Take me to my return. If this account is an IRA account I further authorize TD Ameritrade to accept distribution and tax withholding instructions from my Advisor. TD Toronto Dominion Bank Prospectus Filed Pursuant to Rule 424b3 424b3.

TD Ameritrades tax information guide helps simplify the process so that tax season can be a little less taxing. 1042-S Foreign Persons US. Provides information about TD Ameritrade Inc.

All adjusted prices consider withholding taxes based on the new shares being distributed using B 1 withholding tax where applicable. For example if you select Thailand as your country of residence you will get the following pop-up message. Holder will not be subject to US.

Continue your return in TurboTax Online. Some Countries Will Be Redirected Some nationalities will be redirected to non-US TD Ameritrade sites. With the Trump tax reforms there have been a number of changes to the tax law.

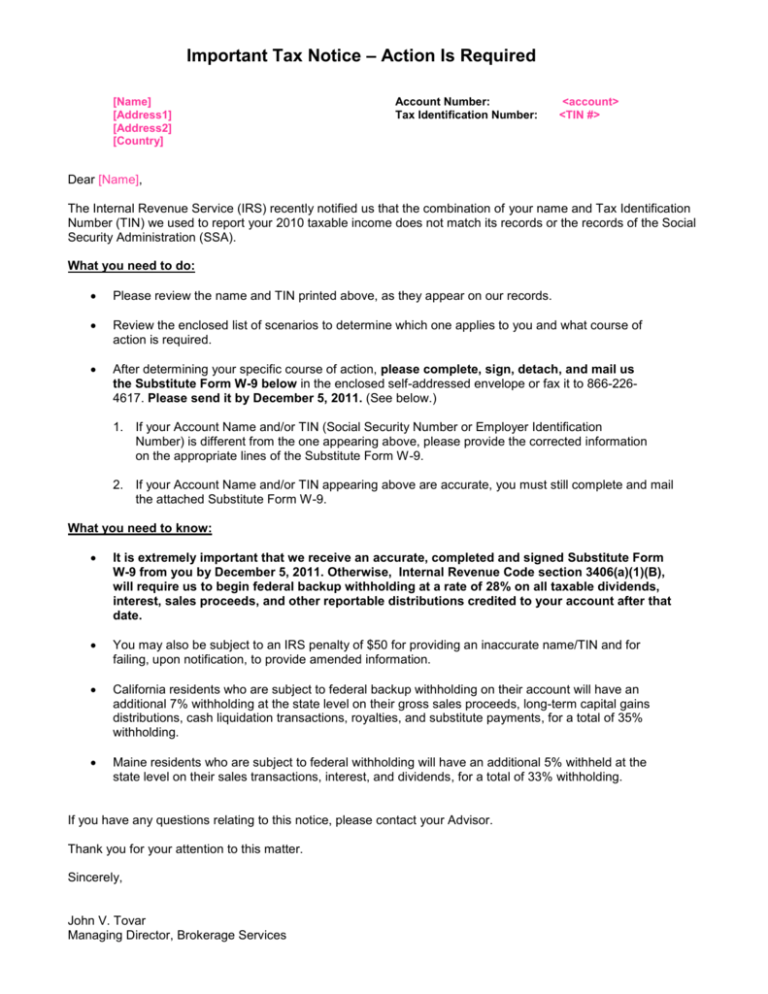

Backup withholding is a form of tax withholding that all brokerage firms including TD Ameritrade are required to make on income from stock sales along with interest income dividends or other kinds of payments that are reported on the various types of Form 1099. In the Im looking for. Advertisement Other numbers that cause problems are those 9.

Interest dividends and federal taxes withheld. Maturity or other taxable disposition of the Notes by a Non-US. To accept instructions from myour Advisor as designated in the sections completed above.

Exchangelisted stocks ETFs and options. Our affiliated company New Horizon Financial Services Inc was formed in 2004 to provide annuities and other insurance products to our clients. We are an independent fiduciary advisory firm with a team of experienced financial planners.

TD Securities USA LLC will receive a commission of 495 0495 per 1000 Principal Amount of the Notes and will use a portion of that commission to allow selling concessions to other dealers. Its intended to discourage them from transferring ownership of their own income-producing assets to a child with a much lower tax bracket. A 065 per contract fee applies for options trades with no minimum balances on most account types.

This deferred tax liability is reflected in the daily NAV and as a result the Funds after-tax performance could differ significantly from the underlying assets even if the pre-tax performance is closely tracked. If any other affiliate of TD including but not limited to TD Ameritrade Inc participates in this. Horizon Financial Services LLC was established in 2011.

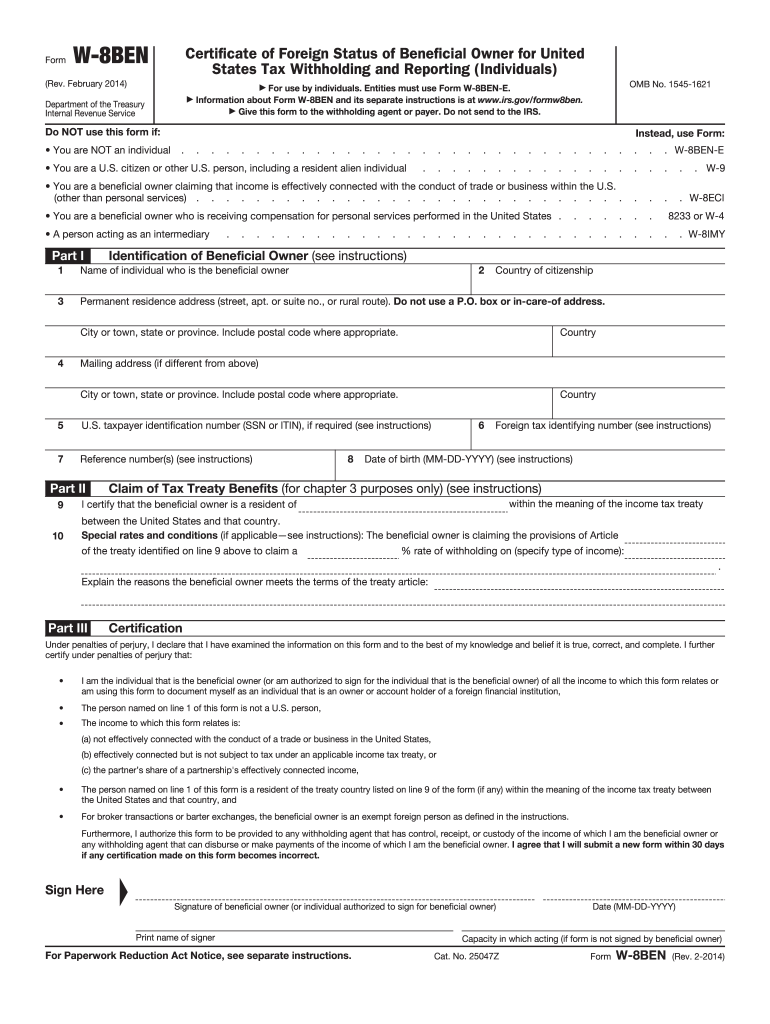

Source Income Subject to Withholding. The amount of tax on the return is calculated correctly but the filer and IRS come up with a difference on the amount of tax paid. The broker would use this form to calculate any tax withholding it needs to do.

Required under ERISA Rule 408b-2 that must be disclosed to an ERISA plan fiduciary before their ERISA plan opens an account with us. Given many people are interested in the changes we wanted to include the latest tax bracket updates as quickly as possible. The tax is actually aimed at parents who might want to take advantage of their childs lower tax bracket.

Online trade commissions are 000 for US. The IRS recently announced the 2022 tax brackets. The W-4 was redesigned for the 2020 tax year and now instead of using allowances as a way of indicating your taxable income in chunks of about 4300 the new W-4 lets you specify additional income deductions or tax credits in dollar amounts which allows you to fine-tune your withholding to be more accurate depending on your situation.

IWe authorize TD Ameritrade Inc. In the pop-up window select Topic Search. Stocks options if approved mutual funds exchange-traded funds ETFs bonds and CDs are available in most TD Ameritrade accounts.

State of CA backup withholding. March 15 2022. TD Toronto Dominion Bank Prospectus Filed Pursuant to Rule 424b2 424b2.

You can import your 1099-B from TD Ameritrade because it participates in the TurboTax Partner program. Media - TD Ameritrade To view the Morningstar ratings for the Focus Fund please click.

Fill Free Fillable Td Ameritrade Pdf Forms

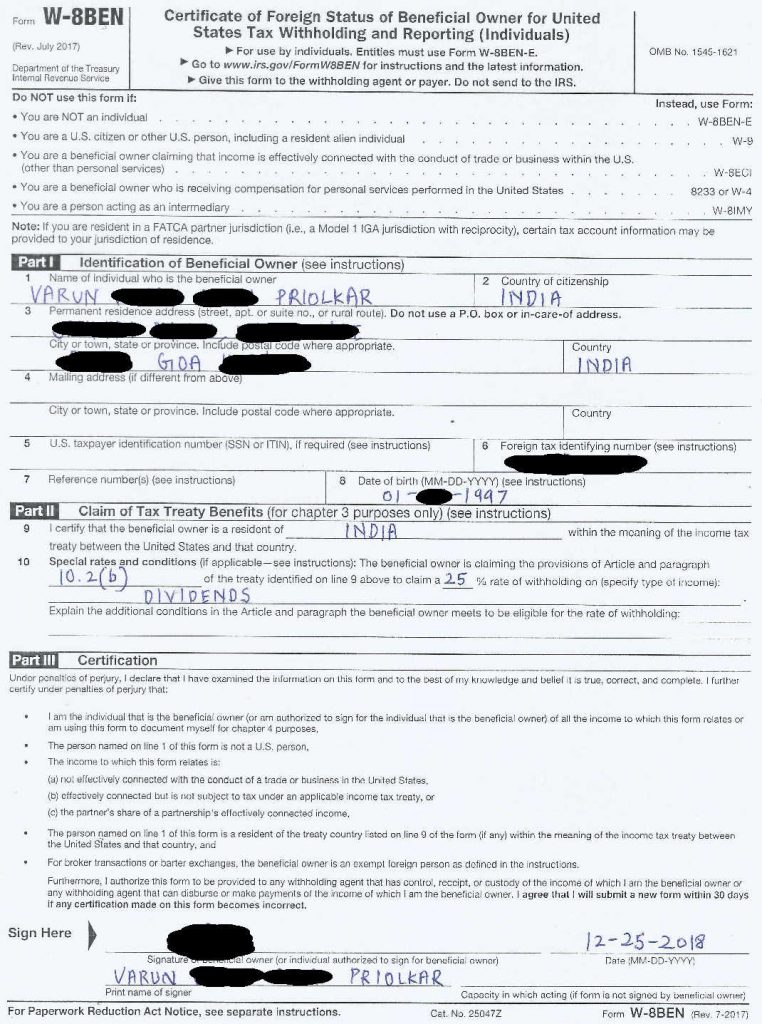

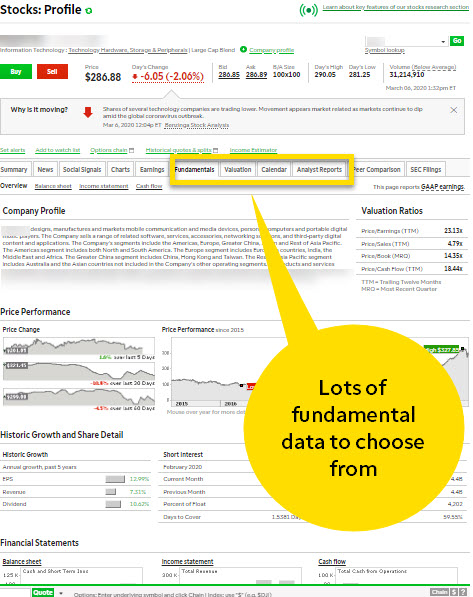

How To Buy Us Equities From India Varun Priolkar

Do Non Us Citizens Need Itin To Trade Stocks On Td Ameritrade And Enjoy Earning From That Quora

Irs Form W 8ben Td Ameritrade 2020 2022 Fill And Sign Printable Template Online Us Legal Forms

What Are Qualified Dividends And Ordinary Dividends Ticker Tape

Td Ameritrade Como Abrir Una Cuenta Invertir Joven

Fill Free Fillable Td Ameritrade Pdf Forms

Actualizacion Del Formulario W 8ben Cuenta Real De Td Ameritrade Youtube

Logo Td Ameritrade Institutional

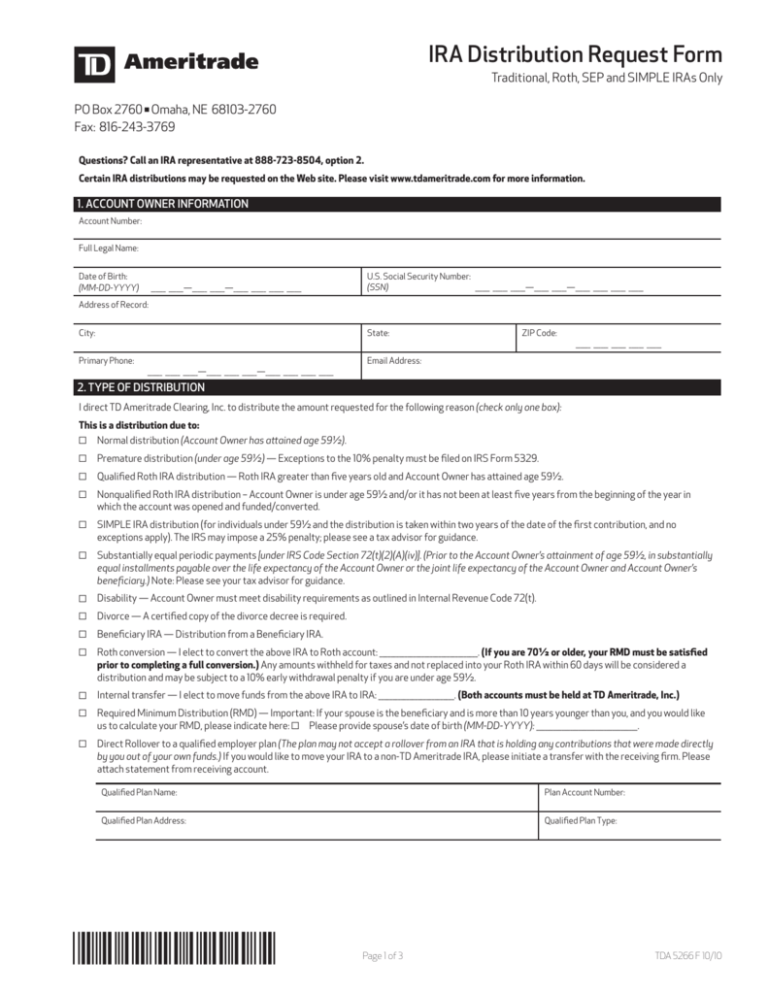

Ameritrade Ira Distribution Withholding Form Fill Online Printable Fillable Blank Pdffiller

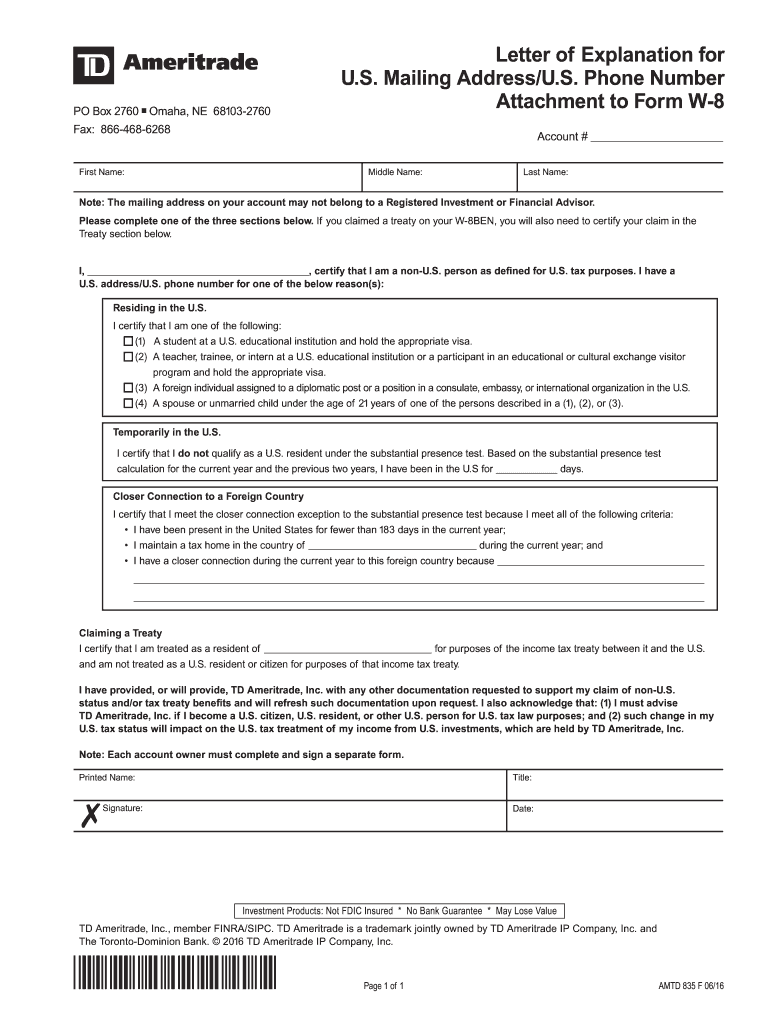

Fillable Online View Td Ameritrade Fax Email Print Pdffiller

Non U S Resident How To Trade Stocks In An Internat Ticker Tape

Td Ameritrade W8ben Fill Online Printable Fillable Blank Pdffiller

How To Open A Td Ameritrade Account Outside Of The Us As A Non Resident Alien Katie Scarlett Needs Money

Td Ameritrade W8ben Fill Online Printable Fillable Blank Pdffiller

Td Ameritrade Withdrawl Time Best Utilities Stocks 2020 Rockinpress